wyoming income tax rate

Use this tool to compare the state income taxes in Colorado and Wyoming or any other pair of states. Wyoming Income Tax Calculator 2021.

Qod Updated How Many States Do Not Have State Income Taxes Blog

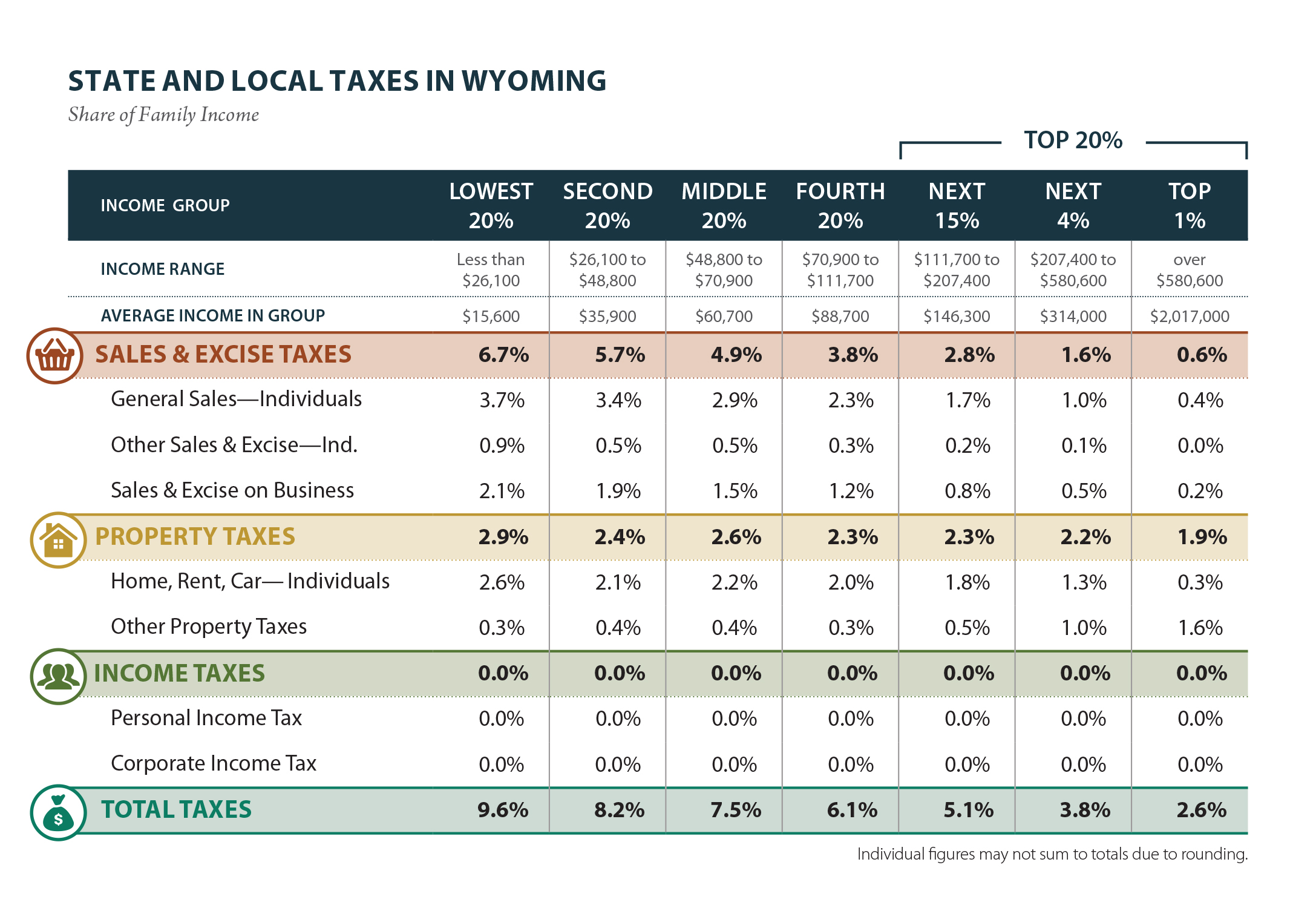

Wyoming ranks in 10th position in the USA for taking the lowest property tax.

. Property Tax The. Whether you chose to live in Wyoming or ended up there by chance you live in a state with a minimal tax burden which is excellent news for your. Address Lookup for Jurisdictions and Sales Tax Rate.

Wyoming Gas Tax. If you make 70000 a year living in the region of Wyoming USA you will be taxed 8387. For tax purposes this is treated the same as ordinary income and can range from 10 - 37 depending on your income level.

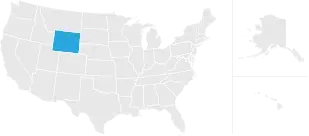

Wyoming does not have an individual income tax. City Departments 62A District Court Pay A Ticket Court Records Search Making Payments Civil Division Traffic Criminal Division. The state income tax rate in Wyoming is 0 while federal income tax rates range from 10 to 37 depending on your income.

The state and average local sales tax rate is 539. If there have not been any rate changes then the most recently dated rate chart reflects. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

No personal income taxes. 4 percent state sales tax one of the lowest in the United States. Wyomings property tax rate is 115 for industrial property and 95 for commercial residential and all.

This income tax calculator can help estimate your average. Wyomings license fee amounts to 0002 for every dollar of in-state assets the business has or 60 whichever is greater. This tool compares the tax brackets for single individuals in each state.

State tax rates and rules for income sales property fuel cigarette and other taxes that impact Wyoming residents. Sales Use Tax Rate Charts. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200.

Wyoming state income tax rate for 2022 is 0 because Wyoming does not collect a personal income tax. Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states. The state gas excise tax in Wyoming is 23 cents per gallon.

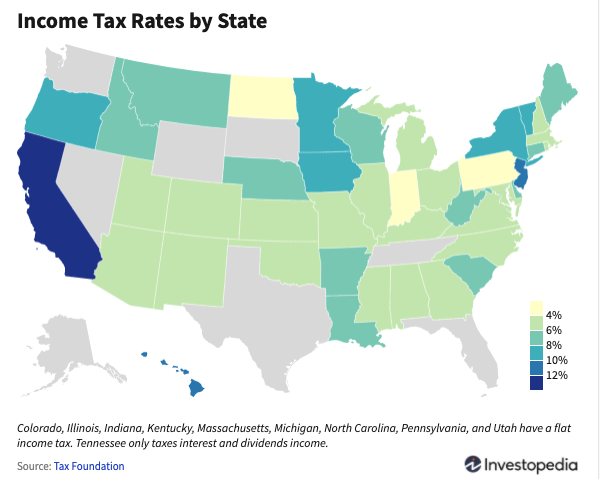

Wyoming also does not have a corporate income tax. This is very low for a combined rate. In Wyoming the median property tax rate is 605 per.

Tax rate charts are only updated as changes in rates occur. Corporate rates which most often are flat regardless of the amount of income. No entity tax for corporations.

Thats the 32nd-lowest tax in the country. If the total value of the businesss in-state assets is under 250000. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund.

Your average tax rate is 1198 and your marginal tax. The average property tax rate is only 057 making Wyoming the lowest property tax taker. The seven tax rates remain unchanged while the income.

Please note new mailing address as we update. Some of the advantages to Wyomings tax laws include. Wyoming income tax rate and tax brackets shown in the table below.

Wyoming has no estate or inheritance tax. The tax on diesel fuel is also 23 cents per gallon. The average effective property tax rate in Wyoming is just 057.

The state rate is 40 the average local rate is 134 total average rate for Wyoming Sales Tax is 534. Find out more on Wyomings income sales and property taxes.

The Most And Least Tax Friendly Us States

Lccc Study Wyo Residents Can Afford Higher Taxes Casper Wy Oil City News

Gulla Cpa The Income Tax Rate Varies From State To State And Some States Impose No Income Tax At All Facebook

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

9 States With No Income Tax Kiplinger

States With The Highest Lowest Tax Rates

Cost Of Living In Wyoming For 2022 Taxes Housing More Upgraded Home

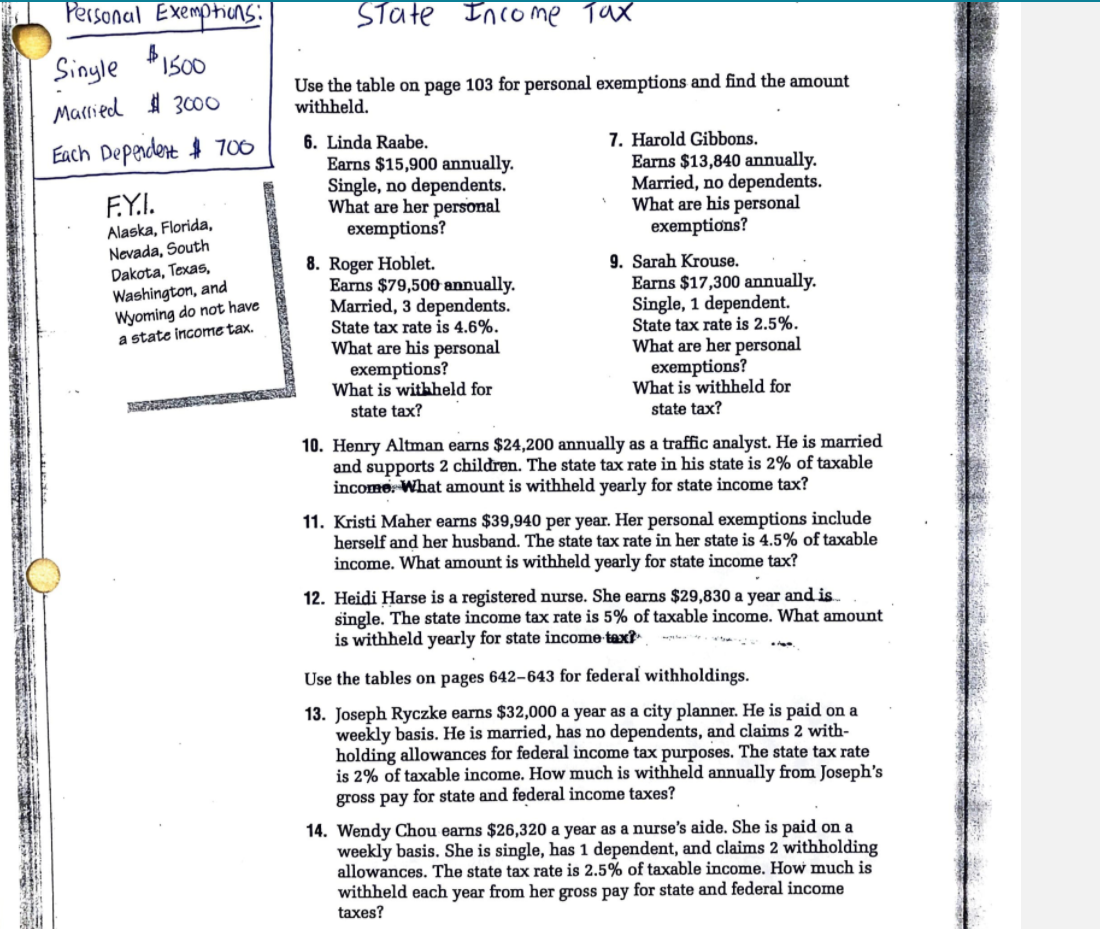

Personal Exemptions State Income 1 Tax Single 1500 Chegg Com

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

States With The Highest Lowest Tax Rates

Historical Wyoming Tax Policy Information Ballotpedia

Taxes And Spending In Nebraska

How Do State And Local Individual Income Taxes Work Tax Policy Center

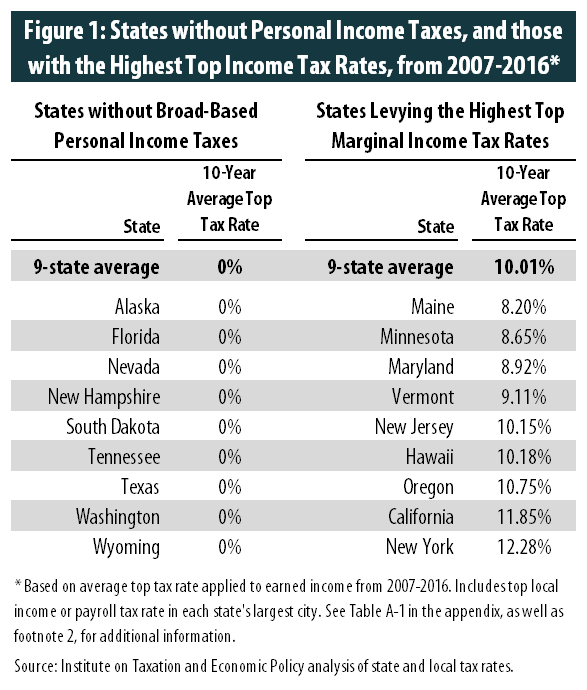

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy